My experience with Bondora Go and Grow – In this detailed step-by-step guide , I’ll show you how to set up* Bondora Go and Grow– from signing up to your first interest payment. You will learn how to generate passive income through the P2P platform, how high the interest payments are, how reputable the platform is, how interest income is taxed and for whom Bondora is suitable.

But before telling you my Bondora Go and Grow Experiences you have to understand – What is Bondora Go and Grow anyway?

Table of Contents

What is Bondora Go and Grow?

Bondora Go and Grow is a P2P product of the Estonian P2P platform Bondora. Bondora has been on the market since 2009, making it one of the oldest and most established platforms in the P2P sector.

On the platform you can invest in different products. Besides Bondora Go and Grow , there are other products such as Portfolio Manager and Portfolio Pro. But here we will only talk about Bondora Go and Grow.

Bondora Go and Grow is currently the most popular product from Bondora. When you invest your money on Bondora Go and Grow, you invest in a large, diversified loan portfolio of more than a hundred thousand individual P2P loans. Bondora itself is a registered lender in several European countries, the loans are granted in Spain, Estonia and Finland and have different rating classes (mainly E- and F-rating). These are mainly consumer loans.

Thus, with Bondora Go and Grow you do not invest in individual loans, but in the entire Bondora portfolio. Individual credit defaults are compensated in such a way that you do not even notice this.

Bondora Go and Grow offers you an annual return of 6.75%.

Overview Bondora Go and Grow

| Headquarter | Tallinn, Estonia |

| Date of incorporation | 2009 |

| Regulation | Yes |

| Buy-back Guarantee | No |

| Minimum Investment Amount | 1 € |

| Auto Invest | Yes |

| Secondary Market | Yes |

| Issuance of Tax Certificate | Yes |

| Maximum Return per Year | 6,75 % |

| Credit Countries | Estonia, Finland, Spain |

| Loan Types | mostly Consumer Loans |

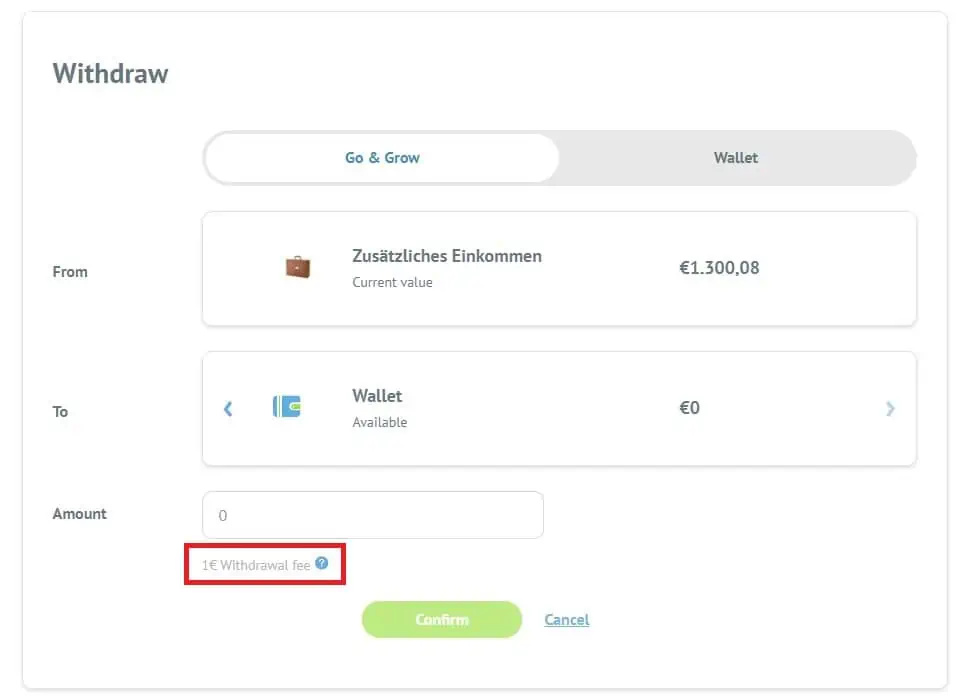

| Incurring Costs: | €1 Withdrawal Fee per withdrawal to the account (regardless of the amount withdrawn) |

| Deposit Limit | Yes (as of 2023: €400/month) |

| Deposit Insurance available? | NO |

| Bonus | Yes, Get €5 Starting Credit NOW*. |

What are Advantages of Bondora Go and Grow?

A decisive advantage of Bondora Go and Grow in comparison to other products or platforms is the is the comparatively high level of security. For example, Bondora retains a portion of the surplus as a reserve to compensate for shortfalls. You also invest in a highly diversified loan portfolio. The default of individual loan recipients can therefore be tolerated.

Even in the early 2020s, when other P2P platforms were more or less struggling with corona-related outages, Bondora was doing very well. Although there were interim payout restrictions, meaning that only partial payouts were possible for a limited period of time, this was only for a short time and all funds were eventually paid out.

Since 2020, Bondora has grown steadily and is now one of the most established and widely used P2P platforms.

In addition to the security and diversity of the portfolio, another major advantage is immediate liquidity. Money that you have deposited in Bondora Go and Grow, as well as the interest generated, can be withdrawn to your bank account at any time. So you are not bound to credit periods and are completely flexible. That is why Bondora Go and Grow is considered by some as an alternative to an instant access account. However, be aware that there is no deposit insurance at Bondora.

Bondora Go and Grow can also be used as an additional passive income stream, as interest earnings are credited to you on a daily basis. And there’s something extremely satisfying about watching your assets grow every day.

Another practical feature is that a Bondora Go & Grow App has recently become available.

What are Disadvantages of Bondora Go and Grow?

One “downside” of Bondora Go and Grow, if you can call it that, is the relatively low annual return of 6.75%. With other P2P products, double-digit returns are to be expected, but in return Bondora Go and Grow offers immediate liquidity and comparatively high security. Whether Bondora Go and Grow is suitable for one thus depends on one’s personal situation, risk affinity and financial strategy.

Who is Bondora Go and Grow Suitable for?

Personally, based on my experience, I think Bondora Go and Grow is a very good product and would therefore recommend it in principle to anyone for the time being.

Bondora Go and Grow is particularly suitable as an entry into the P2P sector. The minimum investment amount is only 1 € and you can withdraw the money at any time. Instead of letting excess reserves sit idle in your overnight account, you can deposit it with Bondora instead and still get a nice interest rate.

Note: Keep in mind that Bondora (like any other P2P platform) does not have a deposit insurance.

Top 3 Providers for your Investment

|  |  |

|---|---|---|

| Provider for instant-access and fixed-term deposits | Stock & Crypto Trading Broker | P2P Platform |

| Up to 4% interest | Only 1 € fee per order (cheapest broker) | 6.75% interest with daily availability |

| Risk-free due to deposit protection | > 1500 ETF savings plans | High security compared to other P2P offerings |

| Read field report | Read field report | Read field report |

| >> Register Now* | >> Register Now* | >> Register Now and get 5 € Bonus* |

Is the Interest Rate of 6.75% Safe?

Be aware that the annual return of 6.75% promised by Bondora is the maximum return, a lower return is not impossible. However, Bondora does a lot to keep this interest rate constant. The actual internal rate of return is higher, but Bondora retains the surplus as a reserve to minimize the risk of default. Thus far, the target return of 6.75% has always been achieved.

Bondora Go and Grow Limit

Bondora has changed the maximum amount you can deposit into your Go and Grow account per month several times in 2022. As of 2023, the monthly deposit limit is 400 euros.

Bondora Go and Grow Unlimited

In April 2022, Bondora launched its new product “Go and Gro Unlimited”. With Go and Grow Unlimited you have the possibility -as the name suggests- to invest money into your Go and Grow Unlimited account without any limit, while with your normal Go and Grow account you are (currently) limited to 400 € per month. However, Go & Grow Unlimited also only offers a relatively meager return of 4% per year. Whether this 4% is worth the relatively high risk is a matter for each individual to decide. In my opinion, however, not, especially since the “normal” Go and Grow was itself without a limit for a long time and the introduction of such a limit together with Go and Grow Unlimited comes across as an indirect interest rate cut.

Bondora Go and Grow Risk

Bondora can be considered very safe compared to other P2P platforms, Bondora is one of the oldest platforms in the P2P sector (founded in 2009). Experience has shown that the greatest risk would be the insolvency of the platform, which would then also take the Bondora Go and Grow product with it. However, future insolvency cannot be completely ruled out for any company. It can be stated that Bondora has been operating profitably so far and therefore insolvency seems unlikely.

Does Bondora Offer a Welcome Bonus?

Yes, when you register for the first time at Bondora, you will receive a Bonus of 5 €. To get the bonus, click on the button below. With this you support this blog, because I also get a commission for it. Thank you very much!

Is Bondora Affected by the War in Ukraine?

As of March 2022, Bondora is not directly affected (Update: As of April 2023, everything is still running normally at Bondora as well). Bondora does not lend in Ukraine, Belarus or Russia. No effects on the loan portfolio are known to date. The borrower countries Estonia, Finland and Spain have only very minor economic ties with Russia. It is becoming apparent that Bondora will continue to grow.

How does it Work with Taxes at Bondora Go and Grow?

Income from P2P loans is in principle subject to capital gains tax in Germany (25% plus soli, plus church tax if applicable). The Go and Grow taxes are to be considered analogously. Depending on the country you live, that might differ.

In general, P2P providers like Bondora do not pay the capital gains tax to the tax office themselves, which is why you cannot submit an exemption order. You must independently report the amount of your income to the tax office in your tax return. In Germany, this can be done by means of the Annex KAP of the tax return. Since Bondora is a foreign company, you enter the total amount of your Go and Grow interest income in the line ” Investment income not subject to domestic tax withholding” .

To get an overview of your interest payments at Bondora Go and Grow, click on the menu item “Account statements” after logging in to Bondora. Here you simply select the desired period and by clicking on “Download” you will receive a PDF of your account statement. You can download a PDF of your annual tax report under “Reports”.

Regarding the exact taxation method of income from Bondora Go and Grow, there are different opinions. In principle, two different types of taxation are distinguished (Keept in mind, that these two options are relevant for Germany. It might be different in your country!).

Standard Taxation

In the traditional calculation, income from P2P loans is taxed as interest income directly in the year of receipt. Regardless of whether the interest income is still with Bondora or you have had it paid out to your account.

“Alternative” taxation (= taxation according to the inflow principle)

Bondora Go & Grow advertises, simply put, that investors do not have to pay tax on their interest until interest is actually withdrawn and credited to the investor’s reference account. As long as no money is withdrawn, there is no credit/realized interest and therefore no taxes need to be paid, as the interest is initially credited to Bondora only virtually (can be seen under Reports –> Bondora Tax Report). This is the more favorable option for investors, as taxes are only paid on interest income actually realized (i.e. interest transferred to your account).

With standard taxation, in the worst case scenario you pay taxes in advance on interest that you do not receive, for example, due to the bankruptcy of a platform.

You are definitely not doing anything wrong with the standard taxation (you may be paying too much tax, but the tax office will certainly not object to that). Whether the “alternative” taxation comes into question for you is best discussed with a tax advisor. In principle, it makes sense for you to decide on one of the two taxation methods from the outset and then follow through with it. That is, if you want to apply the alternative taxation, then you should apply it from the beginning and not jump from the Standard Taxation to the Alternative Taxation.

You can find my detailed experience with the Go and Grow taxes at Bondora as well as other P2P platforms in a separate post on the blog.

Bondora Go and Grow Setup – Step by Step Guide

Setting up Bondora Go and Grow is not difficult. In this tutorial, I’ll show you how to do it and which functions are available.

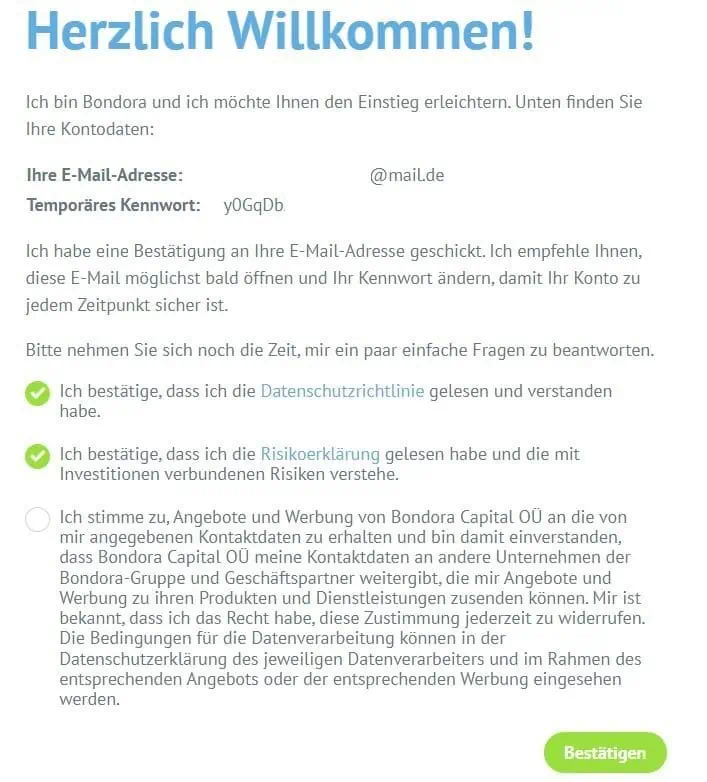

Sign up with Bondora

To register with Bondora, first open the Bondora.com* page. There you click on “Register now”, enter your contact details (email, first and last name, cell phone number) and then click on “Register“. In the following window you confirm that you have read and understood the Privacy Policy and Risk Statement and click on “Confirm”. At the same time you should have received an email from Bondora with a temporary password. Change this password to make sure your account is secure.

Setup Go and Grow Account

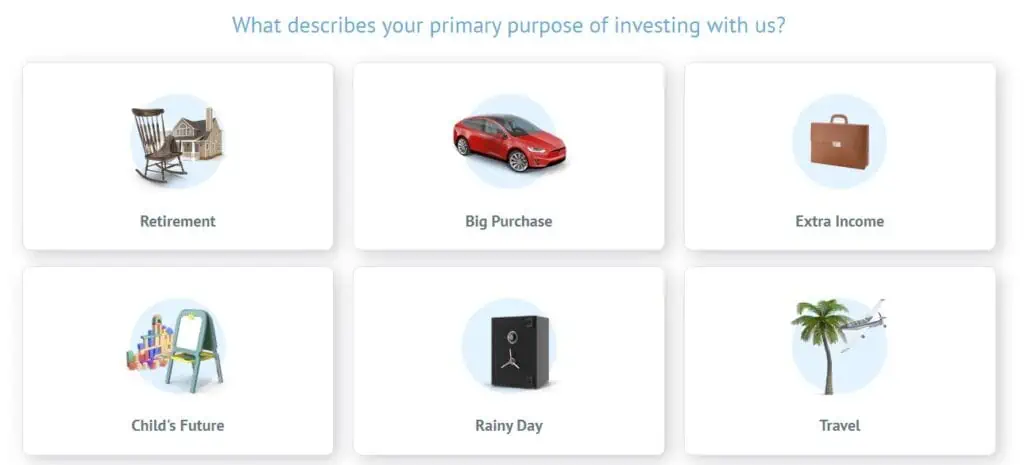

Now you can specify what you want to save on at Bondora. You can choose between the fields “Retirement”, “Big purchase”, “Additional income”, “Future of your child”, “Bad times” and “Travel”. What you click here doesn’t matter in principle and you can change it later anyway. I have clicked here ,,Additional income”.

Now you will see a tutorial introducing Bondora Go and Grow. Just click on “Next”.

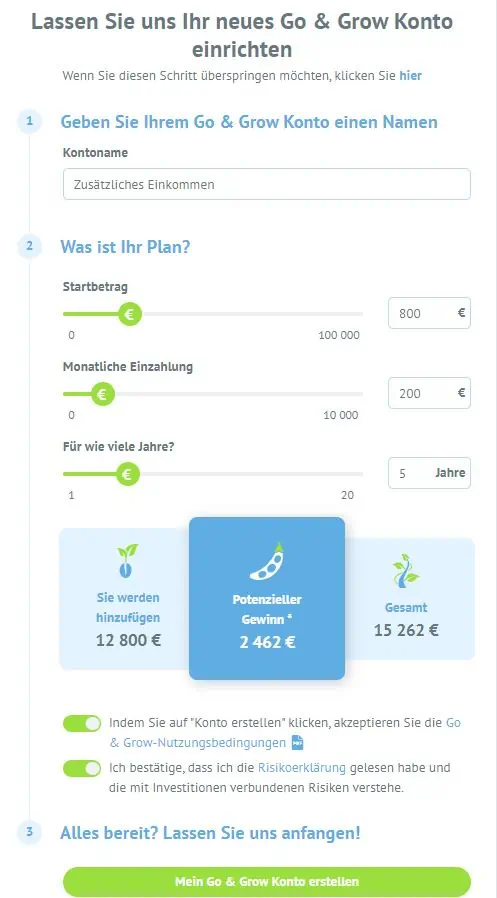

In the next step you can create your new Go and Grow account (you can also skip this step). Assign an account name, set a starting amount you want to deposit as well as your monthly deposit rate and deposit period. At the same time, your potential profit over the specified period is displayed. Confirm the Go & Grow Terms of Use and the Risk Statement and click on “Create my Go & Grow account”.

Your Go & Grow account is now ready for investment. If you want, you can make a payment directly to your Go & Grow account via SEPA (or skip that for now). It is very important that you specify the purpose of the transfer so that your payment can be correctly assigned.

Complete Bondora Go and Grow Account Setup

To complete your account setup and to be able to use all the features, Bondora requires the following proofs:

- Verify bank account

- Transfer an amount (minimum 0,01 €) to your Bondora account

- Verify identity

- Verify your identity by uploading a passport, driver’s license or ID card to Bondora

- Personal data

- Here Bondora requests further personal data from you (e.g. Date of birth, personal ID: this means your identity card number )

If you have provided all the necessary proof, you can now really get started.

Hint: If you haven’t already, now would be a good time to replace your temporary password with a strong password of your own. To do this, click on ,,Settings” –> ,,Change password”.

Go & Grow Account Add Money

If you want to add money to your Go and Grow account, click on “Go and Grow” in the sidebar and then on the “Deposit” button. Transfer the desired amount to your account, specifying the purpose of the transfer. Currently, you can only deposit €400 per month into your Bondora Go and Grow account. Anything above that remains in your wallet for now.

Bondora Functions

On the Bondora site, in the left sidebar, there are various functions, the most important of which I will briefly introduce to you.

Hint: To add or remove features from the sidebar, click your name to the left of the flag in the site header, then click “Change View”. In the “Custom” column, you can also add functions/properties that are hidden by default, such as the secondary market or statistics.

Go & Grow

Here you have an overview of your added deposits, your achieved profits and the total value of your portfolio. Click on the blue burger icon to open more functions.

Under “Forecast” you can simulate your return over time considering a starting amount and monthly deposits.

In ,,Edit Purpose & Goal” you can change the primary reason why you invest with Bondora.

Under “Create a new Go & Grow account” you create another Go & Grow account. Yes, that’s right – you can create multiple Go and Grow accounts that then exist separately (e.g. one for additional income, one for travel). This is quite practical and unique in this form in the P2P space.

By clicking on “Go & Grow Tax Report” you can download a tax report for a specified period and under “Go & Grow Terms of Use” you can download the Terms of Use as a PDF.

If you activate the “Automatic transfer” function, money that is currently in your wallet will be automatically transferred to your Go and Grow account (limited to the monthly limit of currently 400 €). If the function is disabled, you will have to transfer money to your account manually.

Bank Statements

Here you can download your Go & Grow account statements.

Reports

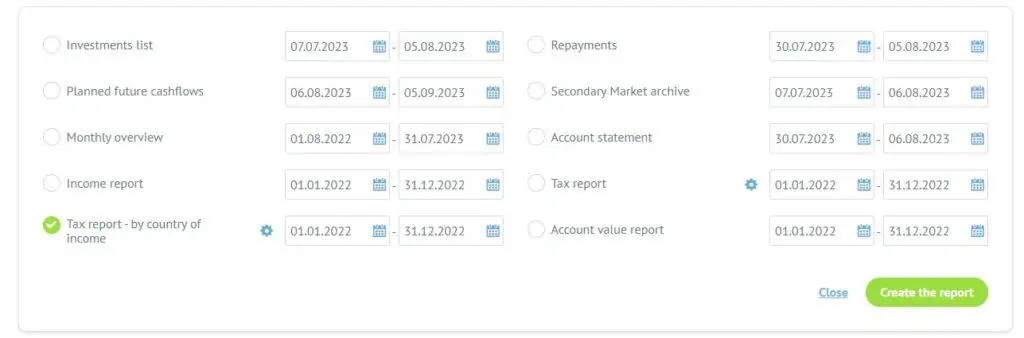

Here you can download your tax report by clicking on “Create report”.

Secondary Market Bondora Go and Grow Experiences

Bondora also offers a secondary market where you can buy loans from other investors at a discount or sell your own investments.

Withdraw Money

Here you can transfer money from your Go & Grow account to your wallet and then to your deposited bank account (or from Go & Grow directly to your bank account). The withdrawal fee is always 1 €.

Settings

Here you can make various settings. For example, you can change your personal information, password, mobile number or email address, as well as cancel your account.

Experiences Bondora Go and Grow

I have been invested in Bondora Go and Grow myself since 2020 and I’m so far very satisfied. I use Bondora as a “temporary storage” for otherwise unused cash amounts in order to achieve a return. If necessary (e.g. stock purchases, planned purchases, etc.), I withdraw the amount or a partial amount and shift it to other asset classes or spend the money. I am not aware of any other P2P product that combines a thoroughly respectable yield of 6.75% with complete flexibility through liquidity. Even though my experience with Bondora Go and Grow has been entirely positive so far, the current €400 limit per month is quite annoying, which is why I’ve also invested in other P2P platforms such as EstateGuru (real estate loans)* or Robocash*.

Bondora Go and Grow Alternatives

Bondora Go and Grow, unlike most other P2P platforms, offers instant availability of your investment amount. However, the annual return is comparatively low at 6.75%. In addition, the deposit limit per month is limited to €400. There is the possibility of unlimited deposit through Bondora Go and Grow Unlimited, but the 4% return offered there is very low. Therefore, the following is an overview of P2P platforms with higher returns than Bondora Go and Grow, which you should take a closer look at as a possible alternative or addition to your portfolio:

EstateGuru (real estate loans)*

Disclaimer/Disclaimer: The information provided here does not constitute investment advice or a recommendation to buy. These are my generally published opinions and experiences as a private investor. I assume no liability for your investment decisions. P2P loans are high-risk products, and no deposit insurance applies. A total loss – however improbable – can never be completely ruled out.